Don't settle, talk to NetWatch!

Like much of the world, alcohol is big business in Canada. A 2023 report published by the Canadian Centre on Substance Use and Addiction stated that 77% of Canadians over the age of 15 had consumed alcohol within the past year. This has several collateral consequences, most importantly, it results in hundreds of fatal car accidents each year and subsequently hundreds of insurance claims as well.

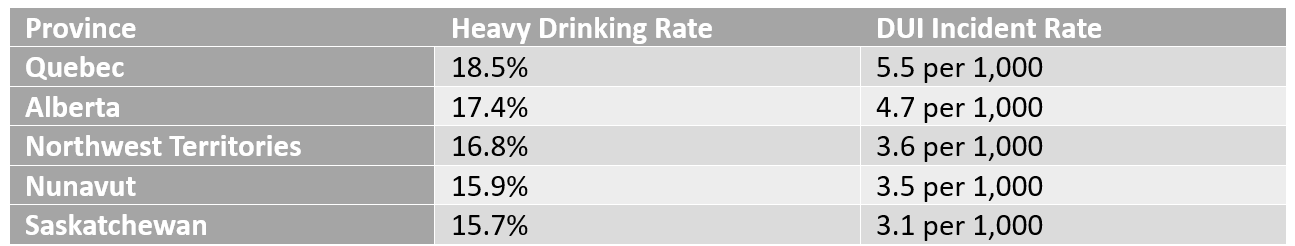

As of 2019, impaired driving was a main factor in 30% of fatal motor accidents across Canada, as well as the number one criminal cause of death[1]. To put this in perspective here is a table outlining how the drinking rate in each province in 2023 relates to the DUI incident rate in that area. I think this really demonstrates the scale of the issue.

So, how do these statistics relate to Canadian insurers and their ability to subrogate a claim? Well, under the Automobile Accident Insurance Act, insurers have the right to seek repayment from the impaired driver, should they have caused injury or damage to a third party or their property. In cases we’ve investigated that involve a DUI incident, injuries and damage tend to be extensive, making them some of the more expensive claims that we investigate. Below is one example of how we have aided our Canadian clients in dealing with claims for alcohol related injuries.

This case relates to an incident in which the claimant had been involved in a motor collision, after allegedly being “overserved” alcohol at the insured’s bar, reporting injuries including but not limited to a traumatic brain injury, disability to their neck and limitations in all aspects of their day-to-day life.

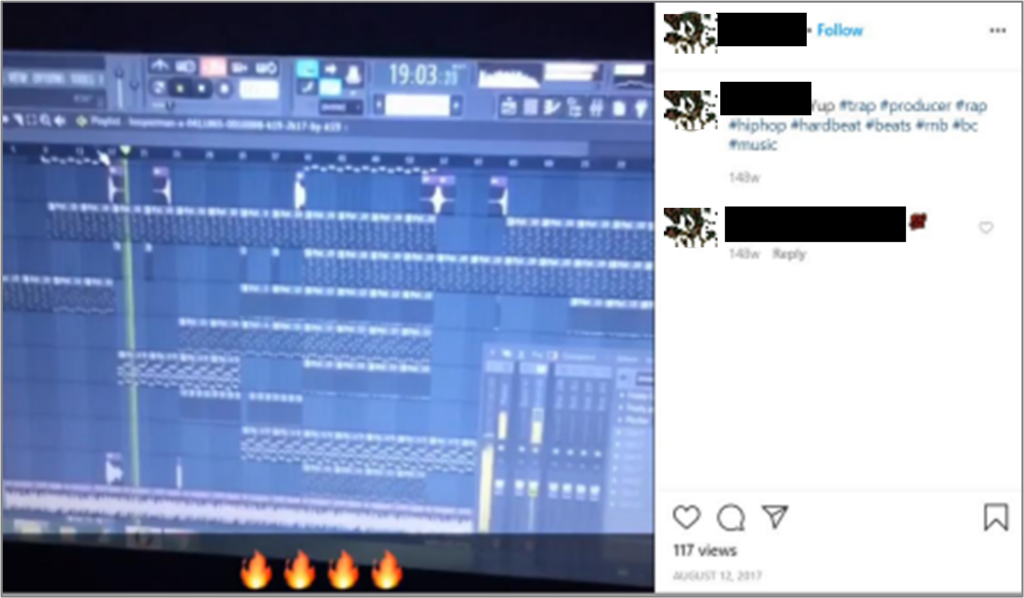

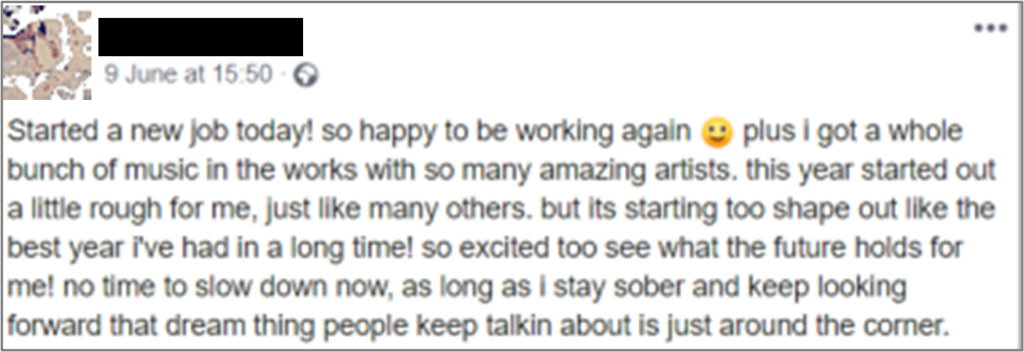

We were able to successfully track down the third party’s social media accounts through their online links to the insured, allowing us to begin thorough research into their lifestyle and how these alleged injuries had really affected them. Our research uncovered extremely pertinent information for our client, notably we were able to confirm the claimant could produce new music and start a new role in the music industry following the incident.

Moreover, since this claim was in relation to excessive drinking leading to a motor collision, we also highlighted the claimant’s drinking habits; whereby we found that the claimant continued to drink heavily following the index incident and would eventually go on to reveal he had a self-described “drinking problem”. He referred to some of his friends as enablers of his problem and suggested he had previously considered his addiction as a joke before starting to recover approximately two years following the incident, indicating his drinking habits continued for an extended period following the collision.

But how was this information useful to our client? Well we also knew the claimant and insured were known to one another following the discovery that they were linked to one another on social media; it was therefore likely that the claimant frequented the insured’s bar prior to the index incident and frequently drank to excess. As the insured knew the claimant, it was also highly likely that they were aware of the claimant’s drinking habits and allowed this behaviour to continue in their establishment unchecked; meaning any liability for the claimant’s injuries from the collision after their departure from the insured’s premises, could be shifted to the insured themselves, with our client no longer being liable to pay out a settlement.

Don’t settle, talk to NetWatch

This is just one example of where NetWatch was able to help a Canadian client in a case of claim subrogation. But this is hardly an isolated incident. The links we were able to discover, that saved our clients from paying out a settlement, were only possible thanks to our rigorous investigative techniques. A decade of experience allows us to provide extensive insights into the lives of the people involved in an incident. Finding information on their lifestyle prior to the index incident to determine if this was an isolated event, or part of a wider pattern of behaviour, as well as how the incident affected and changed their life. We also shine a light on the incident circumstances, looking at the venues to ascertain what was happening on the night in question with a view to getting a true picture of a subject’s version of the events.

If you’re an insurer who frequently deals with these kinds of issues, I urge you to contact us. We’d love to help!

Get Full Online Footprints in Seconds with Profile Finder+

Effortless Digital Background Checks for Informed Decisions

Learn moreThe UK’s most trusted open source and social media investigations company. Get the best intelligence available.

© 2025 NetWatch Global Limited - enquiries@netwatchglobal.com